I have decided to show the Off-hour ordering since the usual ordering is the same as this one only that this order is placed during off hours before the pre-opening and after the run-off time as per PSE time trading hours.

Off-hour ordering allows investors who are in a different time zone to place their order in advance. Such order are queued and will be automatically placed in the system at the opening of the trading at PSE.

For our example below I have use JFC(Jollibee Food Corp.) for our Off-hour ordering:

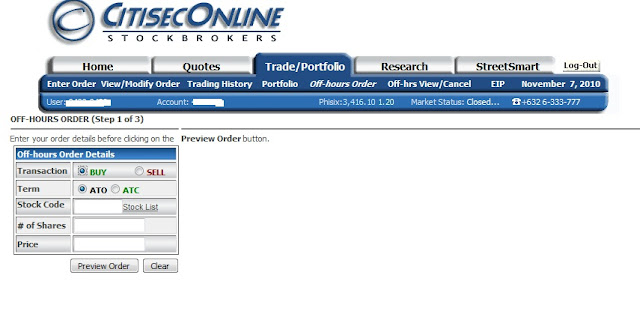

Log in to your account and click the TRADE/PORTFOLIO tab and click OFF-HOUR ORDER

Enter the the stock you are buying or selling in the field STOCK CODE

Enter the number of shares you wanted to buy and the price you wanted to purchased the said stock. If you look at the other two boxes in the side you will noticed that quotes for the same stock is shown. On the BID ASK box you will notice that there is a size and price column. These columns indicate the number of shares being ordered or being sold with the corresponding price these investors are willing to trade.

At the same time be mindful that the bid or ask price is not limited to the listed prices in the first box. With the new trading system there could be more than three fluctuation as long as it is within the two threshold set by PSE as per the implementing rules and regulation. To know more about the Static and Dynamic threshold you can read my post here.

You can refer to the other box for other information you need to determine at what price and quantity you can order or sell. But again such decisions entails other factors which will be discussed on other topics.

You can refer to the other box for other information you need to determine at what price and quantity you can order or sell. But again such decisions entails other factors which will be discussed on other topics.

After entering desired price and quantity you can preview your order details. In the preview below you can see the details of charges and total purchased cost or proceed before continuing your order. Be sure to check the total purchased or proceed before confirming your order. Sometimes you may not have enough funds to support the purchased or your proceeds might be below your cost thus leading you to loss.

Type in your password and click PLACE BUY ORDER(or SELL if selling) to confirm your order or CANCEL ORDER to cancel which will bring you back to the order section and make revision.

After approving your order the window below will pop out as a confirmation of your order.

To view your orders and still make changes you can go to the OFF-HOURS VIEW/CANCEL(for regular ordering you can go to the VIEW/MODIFY ORDER)